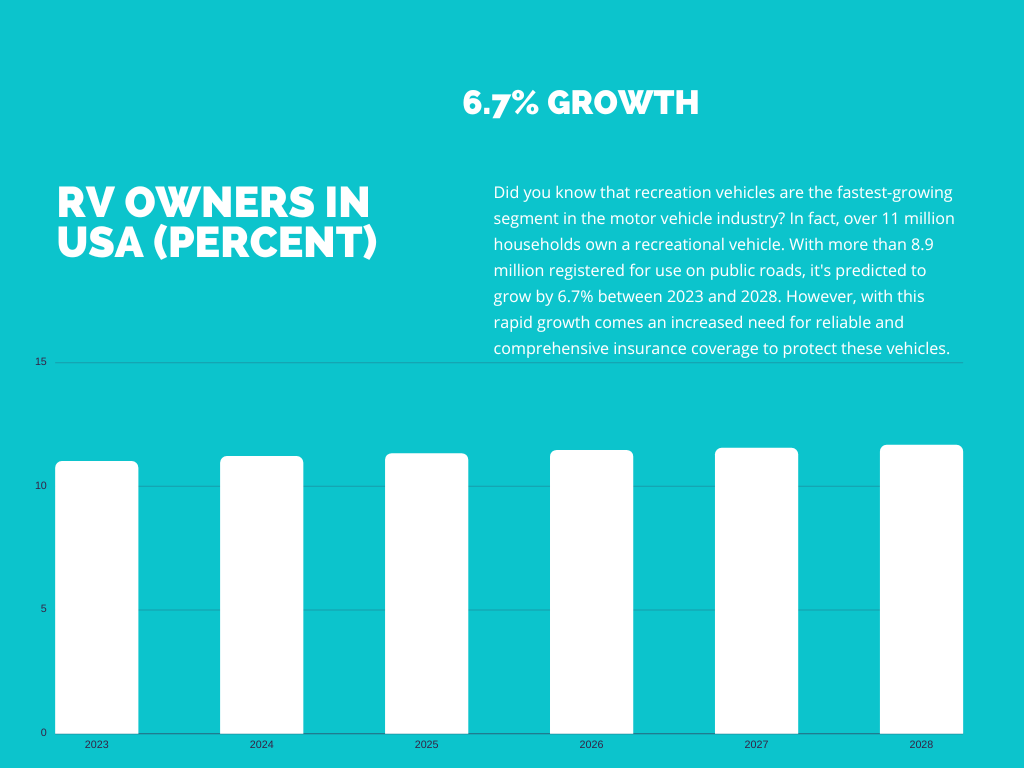

Did you know that recreation vehicles are the fastest-growing segment in the motor vehicle industry? In fact, over 11 million households own a recreational vehicle. With more than 8.9 million registered for use on public roads, it’s predicted to grow by 6.7% between 2023 and 2028. However, with this rapid growth comes an increased need for reliable and comprehensive insurance coverage to protect these vehicles.

Fortunately, many great insurance companies specialize in providing coverage specifically designed for RV owners. From full-time travelers to weekend warriors, these companies offer policies tailored to meet the needs of all types of RVers while also offering competitive rates and discounts.

With so many options available, it can be overwhelming to find the right one. Fortunately, we’ve researched and narrowed down your choices to 8 top-rated RV insurance companies.

These insurers have an average customer satisfaction rating of over 4 out of 5 stars. In addition, they offer a wide range of coverage options tailored to your specific needs. Plus, their premiums are competitively priced with no hidden fees or surprises. So get ready for peace of mind knowing you’ll be safeguarded from whatever life throws at you while traveling in your recreational vehicle!

Types of RVs

1. Motorhomes – These companies typically cover Class A, B & C motorhomes.

2. Fifth Wheels – Fifth wheels (or campers) that have a tow hitch and can be towed behind a truck or other vehicle are generally covered.

3. Folding Campers – These companies often cover pop-up campers and other folding camper trailers.

4. Toy Haulers – Toy haulers offer the versatility of utility trailers for transporting motorcycles, ATVs, other recreational vehicles, and camping gear. Most RV insurers will cover them.

5. Travel Trailers – Travel trailers or trailers that can be towed behind a truck or other vehicle are typically covered.

6. Gooseneck Trailers – These trailers attach to the bed of a pickup truck and are often used for hauling large items, such as horses or boats. Most RV insurers will cover them.

7. Trucks with Campers – Specialty trucks with attached campers, such as a slide-in truck camper, are usually covered.

8. Park Models – These recreational vehicles are designed to be used in RV parks and other permanent camping sites. Many insurers will cover them.

Is RV insurance required?

Most states require that you have some form of insurance before operating a recreational vehicle on public roads. The type and amount of coverage required varies from state to state, so it’s important to check the specific laws in your area. For example, insurance is not required in all states for campers and trailers towed behind another vehicle. However, you may still want to purchase a policy to protect your investment.

Benefits of buying recreational vehicle insurance

When you’re out on the open road, it’s important to ensure you’re properly protected. Purchasing recreational vehicle (RV) insurance provides financial security if anything happens on the road. Here are some major benefits of having RV insurance:

- Comprehensive Coverage: RV insurance covers damage to your vehicle from various sources, including theft, vandalism, fire, and collisions.

- Liability Coverage: If you cause an accident while operating your RV, liability coverage helps protect you by covering the costs of property damage or bodily injury to those affected.

- Medical Payments Coverage: This type of coverage helps cover medical expenses for those injured in an accident while riding in or operating your RV.

- Uninsured/Underinsured Motorist Coverage: If you’re involved in an accident with an uninsured or underinsured driver, this type of insurance can help cover the damages to your RV and medical costs for any injured passengers.

- Replacement Coverage: If your RV is damaged beyond repair, replacement coverage can help cover the cost of replacing it with a new one.

How to choose the right RV insurance company

When searching for RV insurance, it’s important to find a company that offers the right coverage at the right price. In addition, you’ll want to ensure they have strong customer service and know the ins and outs of RV insurance. Here are some tips to help you choose:

Coverage

Determine what type of coverage you need: Different companies offer different types of coverage, from basic liability to comprehensive packages of extra coverage that cover everything from accidents and damage to medical expenses and roadside assistance. Make sure you know what type of coverage works best for your needs before you choose a company.

Deductibles

Different companies offer different deductible options, so you know your financial situation and how much you can pay out of pocket.

Compare rates

Different insurers will charge different premiums for the same coverage, so it’s important to compare rates from several companies before deciding.

Discounts

Many insurers offer discounts for members of certain organizations or for having multiple policies with them. See what kind of discounts are available and if they apply to you.

Reviews

Reading customer reviews can give you an idea of what other RVers think of a company and how they rate their customer service.

Customer service

If you have any questions or concerns, contacting the company directly before deciding is a good idea.

How much does RV insurance cost?

The cost of RV insurance will vary based on your choice of insurance policies. If your policy is deemed too costly, it might be worth more. On the other hand, unless your insurance has a higher limit, your premium might go lower.

The cost of RV insurance also depends on the type and size of your vehicle, age, driving history, and other factors. Generally, RV insurance premiums can range from around $500 to $2,000 annually.

Ultimately, the best way to determine how much RV insurance will cost you is by getting quotes from multiple companies. Comparing prices and coverage will help you get the most bang for your buck.

What coverage do I need for my Recreational Vehicle (RV)?

When insuring your RV, the type of coverage you need will depend on how and where you use it. Depending on the type of recreational vehicle you own, various options are available for coverage.

If you plan on using your RV for extended periods, or if it is your primary residence, you may need full-time coverage that includes protection from physical damage, liability protection, and uninsured/underinsured motorist coverage.

Suppose you use your RV for occasional road trips and weekend adventures. In that case, you may only need basic coverage, such as collision and comprehensive insurance, which will protect your RV from damage caused by accidents, theft, and other occurrences.

What does RV insurance cover?

“RV insurance coverage typically covers physical damage to your recreational vehicle, including collision and comprehensive coverage. It will also protect from liability in case of an accident that causes injury or property damage. Depending on which policy you choose, it may also include additional coverage, such as roadside assistance and emergency expenses for medical bills.

If you rent your RV, you may also need additional coverage to protect you from any damage or liabilities arising from an accident.

What is vacation liability RV insurance?

Vacation liability RV insurance is additional coverage to travel trailer insurance that protects if you rent out your recreational vehicle or allow others to use it. This policy covers any property damage, personal injuries, or medical expenses resulting from a fault accident or using your RV and legal fees if someone sues you for damages.

It is important to note that vacation liability insurance does not cover damage caused by a vehicle breakdown or mechanical failure, so you should ensure your RV is in good condition before renting it out.

Tips on getting the best deal and discounts on RV insurance

Shop around: Compare the plans and prices several RV insurance companies offer to get the best deal. Don’t be afraid to ask questions and shop around, as hidden discounts or additional coverage options may be available.

A. Bundle your policies:

Many RV insurance providers offer discounts when you bundle multiple policies, such as an RV insurance policy with home or auto insurance.

B. Maintain a good driving record:

Keeping your driving record clean can help you qualify for discounts on your RV insurance premiums. Make sure to follow the rules of the road and avoid any major traffic violations.

C. Install safety features:

Adding additional safety features to your RV can help you qualify for discounts and potentially reduce your insurance premiums. Check with your RV insurance provider to see what safety features they require or recommend.

D. Maintain a good credit score:

A good credit score can be beneficial when getting the best rates on RV insurance policies. In addition, keeping up with payments and staying current on bills can help you maintain a good credit score.

E. Ask about discounts:

Many RV insurance companies offer additional discounts to customers, such as multi-policy discounts or loyalty rewards programs. Ask your provider if any applicable discounts are available to you.

F. Pay upfront:

Some RV insurance companies may offer discounted rates and additional discounts if you pay the full policy upfront. Check with your provider to see if this is an option for you.

Take time to shop around for insurance quotes.

RV Insurance rates vary depending on driver history, the state of the car, and whether you are looking to stay in the RV full-time or go on holiday. Other coverage options like the pet and accessory policy will likely increase the cost. Asking a variety of insurers for insurance for RVs is a good strategy for you. People comparing estimates before buying often find the best price. You can contact an insurance company directly if there is no time to shop. These experts often advise and direct you toward businesses offering attractive rates and policies that satisfy your specific need.

It’s important to look at the insurance cost and the coverage quality. Be sure to ask each insurer about their customer service record, coverage and limits available, and any exclusions that may apply, such as age or mileage restrictions. Make sure you understand what is covered before making your decision.

Top Recreation Vehicle Insurance Companies for RV Owners

Nationwide

(Best Overal and for Multiple Discounts. Have the best online resources)

• Nationwide is an insurance underwriter that offers policies for RVs, motorhomes, travel trailers, and campers.

• Coverage includes liability for bodily injury and property damage, collision insurance, medical payments, liability limits, and uninsured/underinsured motorist coverage.

• Comprehensive insurance covers theft, vandalism, fire, and natural disasters.

• Optional coverages such as safety glass replacement and vacation liability can be purchased.

• There are a variety of discounts available, including multi-policy bundles and discounts for taking an approved state RV safety course or being a member of a qualifying organization.

• Policyholders can save more by driving safely and having continuous coverage over three years or utilizing the On Your Side review process.

Good Sam

(Best RV Insurance Agency, good for full-time RVers.)

• Good Sam Insurance Agency is a network of insurers, including National General, Progressive, Safeco Insurance, and Foremost Insurance Group.

• Good Sam can help find the best price for RV coverage and works with MexicoInsuranceOnline.com to provide additional comprehensive and collision coverage if going to Mexico.

• Coverage: personal liability insurance, medical payments for third parties visiting the RV, personal belongings coverage, and an emergency expense allowance.

• Good Sam offers discounts of up to $521 a year, including those for multiple vehicles, paid in full discount, multi-policy discounts of up to 10%, storage savings, safety, and anti-theft device installation, and safe driving practices.

National General

(Best for Full Replacement Cost Coverage.)

• National General Insurance offers personalized RV coverage, including specialized equipment, full replacement cost, and personal belongings.

• Multiple discounts are available, as well as general liability coverage similar to a homeowners policy.

• An online quoting tool and custom policies are offered through an agent; Online resources include safety tips, RV types, and an RV e-book.

• Policyholders can manage their policy online with the help of a top rating from credit agency AM Best and a stellar rating from the Better Business Bureau (BBB).

Progressive

(Best for Disappearing Deductibles. Good add-on services)

• Progressive is an insurance company that offers extensive RV insurance options.

• Add-ons are available for customizing policies, such as vacation liability, pet injury coverage, roadside assistance, total loss replacement, and more.

• Policyholders can start with a basic policy for $125 per year or customize the policy with tailored coverage, including bodily injury liability, property damage liability, and other collision coverage.

Roamly

(Best for Renting Out Your RV.)

• Roamly offers motorhome and camper owners comprehensive commercial insurance when their RV is listed on rental platforms like Outdoorsy.

• Renters can purchase protection packages, including trip protection, interior damage, travel expenses, and medical insurance.

• Roamly covers rented RVs for actual cash value during a rental period and includes $1 million in liability insurance protection for each trip.

Auto-Owners Insurance

(Best for Customer Service)

• Auto-Owners Insurance has a strong reputation for customer service.

• This makes it a great choice for RV owners.

• They offer various discounts, including a green discount, one for on-time payment, and one if no young drivers are listed on the policy.

• Auto-Owners’ RV insurance is unavailable online; quotes must be obtained verbally or by email.

Allstate

(Best for policy bundles)

• Allstate is a well-respected insurance company that provides motorhome and RV coverage.

• Customers may choose from various policies, from auto and renters insurance to life and identity insurance.

• They offer policy bundling with coverage for bodily injury and property damage, towing reimbursement, sound system protection, and more.

• Comprehensive coverage for losses due to theft, vandalism, fire, etc., is also available.

Safeco

(Coverage and discount options for part-timers)

• Safeco offers coverage for RVs used less than 250 days per year.

• Option to customize RV insurance with a wide range of coverages.

• Offering discounts for motor homes, travel trailers, fifth wheels, pop-up campers, and camper vans.

The Hartford

( Excellent customer service)

• The Hartford is our top choice for RV insurance due to its strong J.D. Power rankings and good customer service.

• Customers can get online quotes from The Hartford; discounts are available for bundling policies.